This article continues a series analyzing this year’s Urban Science/Harris Poll survey. The survey delves into consumer perceptions of the relevance of the traditional automobile dealership model.

The past few years have been like a roller coaster ride for auto dealers, and new challenges have just begun.

It wasn’t long ago dealers were frantically trying to deal with low inventory levels due to a severe chip shortage. This scarcity, compounded by the global pandemic that sparked a surge in pent-up buyer demand at a time when most face-to-face business was halted, drove vehicle prices to unprecedented levels. Dealers rethought and readapted their business models and sales strategies in response to these market dynamics. The result was record-high transaction prices.

Now a new set of consumer needs and economic factors are compelling dealers to pivot again. Although dealership lots are now well-stocked, economic pressures have made buyers more cautious. High interest rates, diminished trade-in values and limited financing options are substantial barriers to sales. These issues arise at a time when affordability is a primary concern for a significant majority of auto buyers (68%) and nearly half of dealers (48%).

Additionally, consumers are increasingly worried about the costs of service (48%) and insurance (48%). Dealers must work with consumers to overcome these barriers, while almost a third of dealers (31%) are concerned about maintaining stable inventory levels.

Despite these challenges, there are strategies dealers can employ to overcome these barriers and attract consumers to their showrooms. Price (65%), dealership reputation (48%) and trade-in value (47%) are the three strongest attributes buyers seek when looking for dealerships.

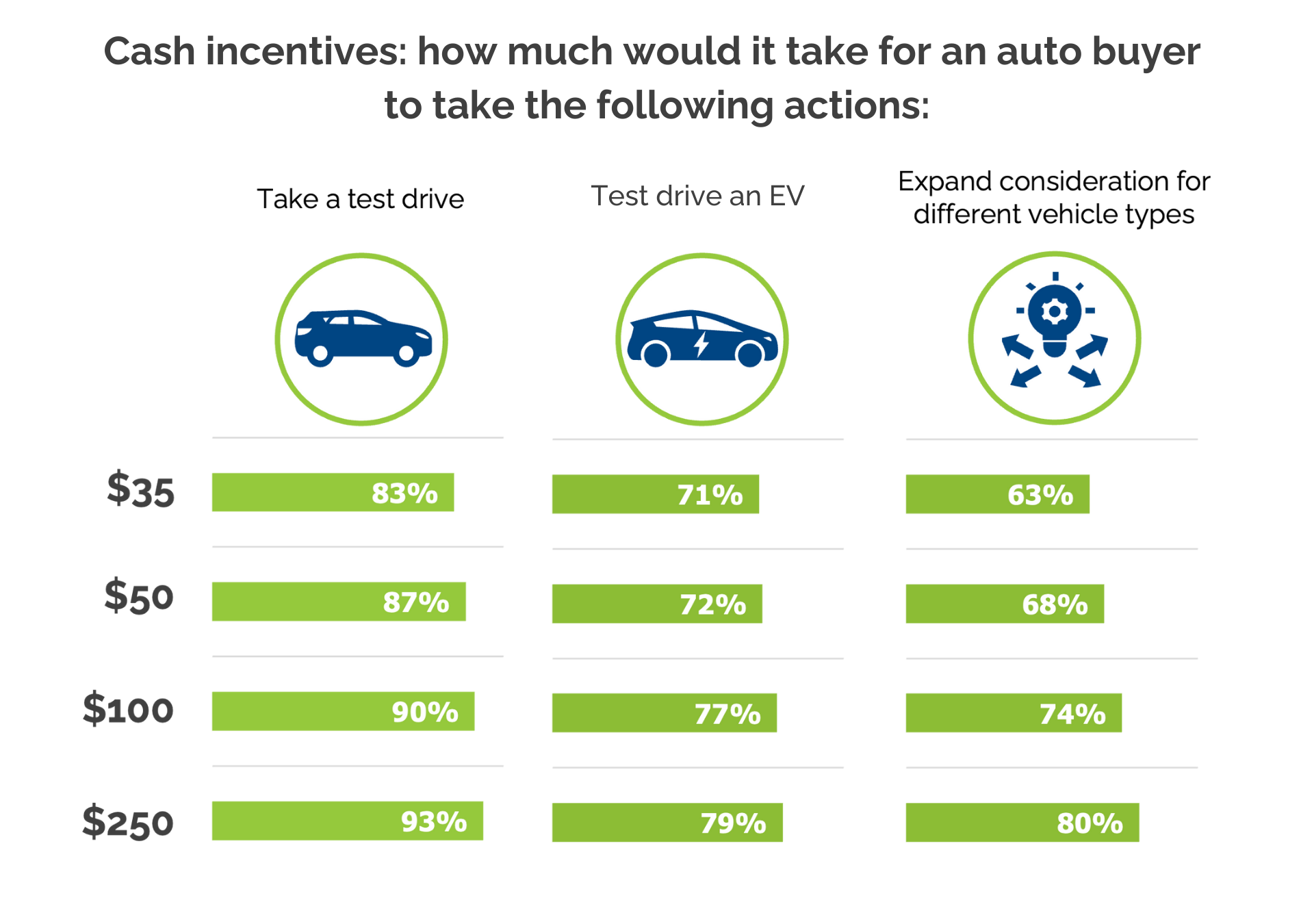

The good news is that many manufacturers are offering incentives to attract customers to their dealers. Even without manufacturer incentives, though, dealers can entice consumers into their stores with incentives as low as $35.

The Power of Incentives

Survey results indicate that buyers respond to $35 incentives in surprising ways. Most respondents (83%) indicated that such an incentive would entice them to take a test drive. Almost three-quarters of respondents (71%) report the $35 incentive would compel them to test drive an EV (71%). And 63% of respondents say the same incentives would encourage them to consider other vehicle types.

Shoppers Are Active

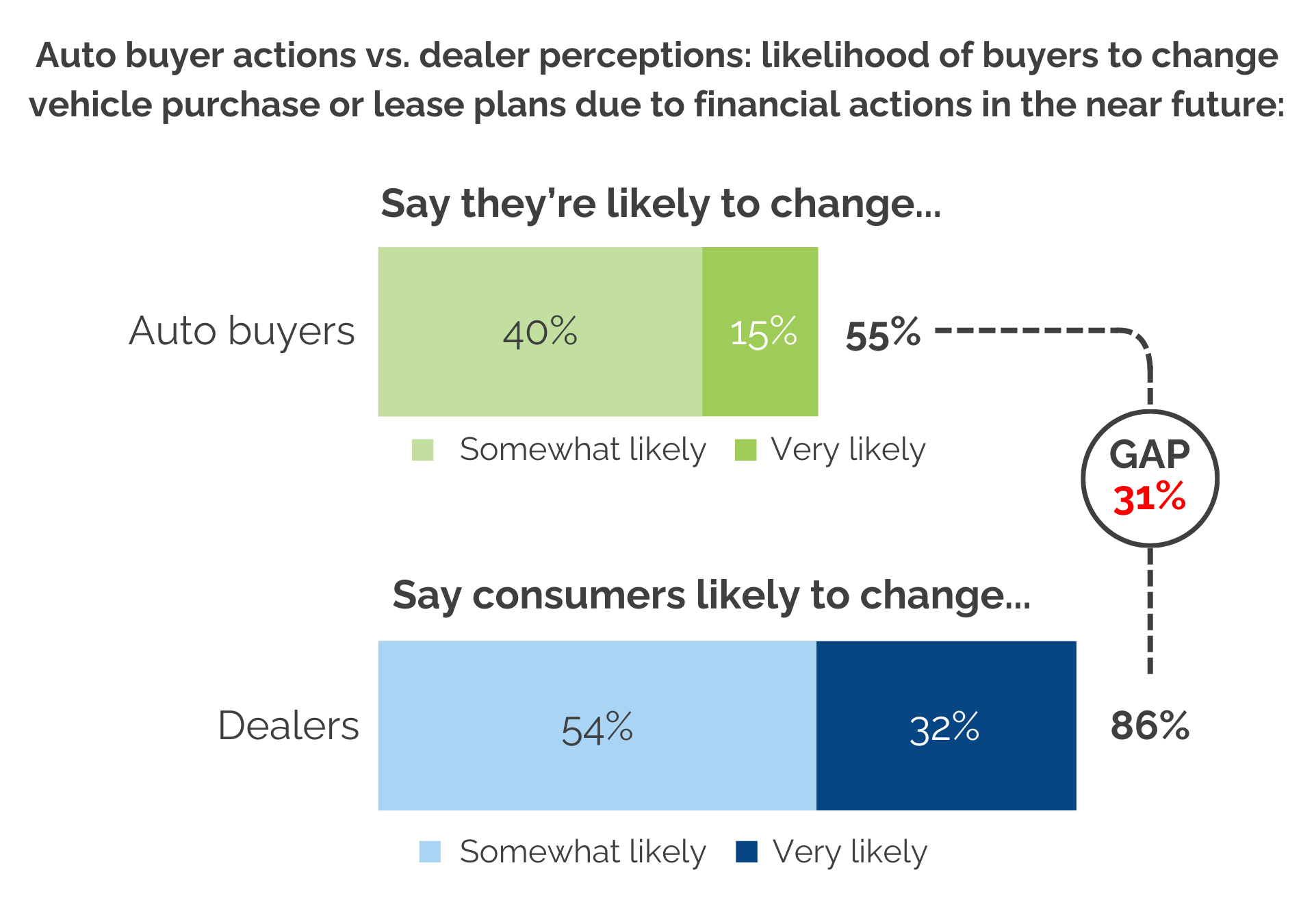

Economic pressures notwithstanding, consumer activity remains robust. Although 86% of dealers believe that consumers are somewhat likely (54%) or very likely (32%) to change their purchasing plans due to financial concerns, data suggests otherwise. While more than half (55%) of potential auto buyers surveyed agree that economic factors will alter their buying plans, only 15% are very likely to do so. In fact, auto shopper activity remains at the same rate as a year ago.

Consider these additional findings from Urban Science about consumer shopping behavior:

- On average, 2.5 dealerships are considered.

- 1.9 dealerships are visited.

- Almost half of the buyers submit requests for a quote or car price from a specific dealer.

In addition to budget-friendly vehicle options, shoppers are interested in exploring alternative financing and leasing options, finding lower interest rates and considering new technologies such as EVs.

Finding and Keeping Well-Qualified Leads

In today’s market, the importance of securing well-qualified leads has significantly increased. The majority (75%) of dealers report that leads are more important now than five years ago, with 36% stating they are much more important.

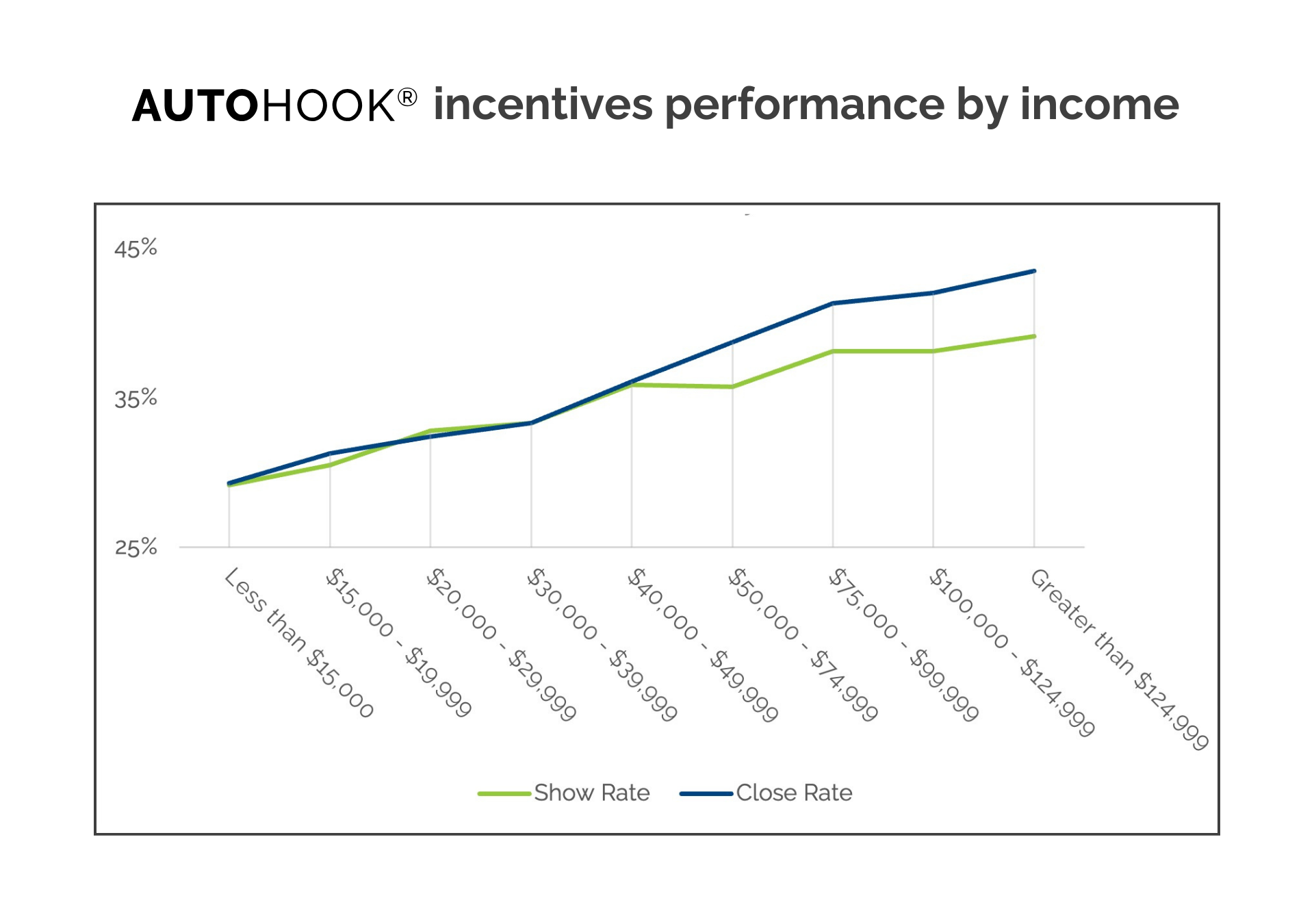

And well-qualified leads are more likely to defect. An Urban Science analysis shows that dealers, on average, face a 17% defection rate and leads earning over $75,000 per year tend to have higher-than-average defection rates.

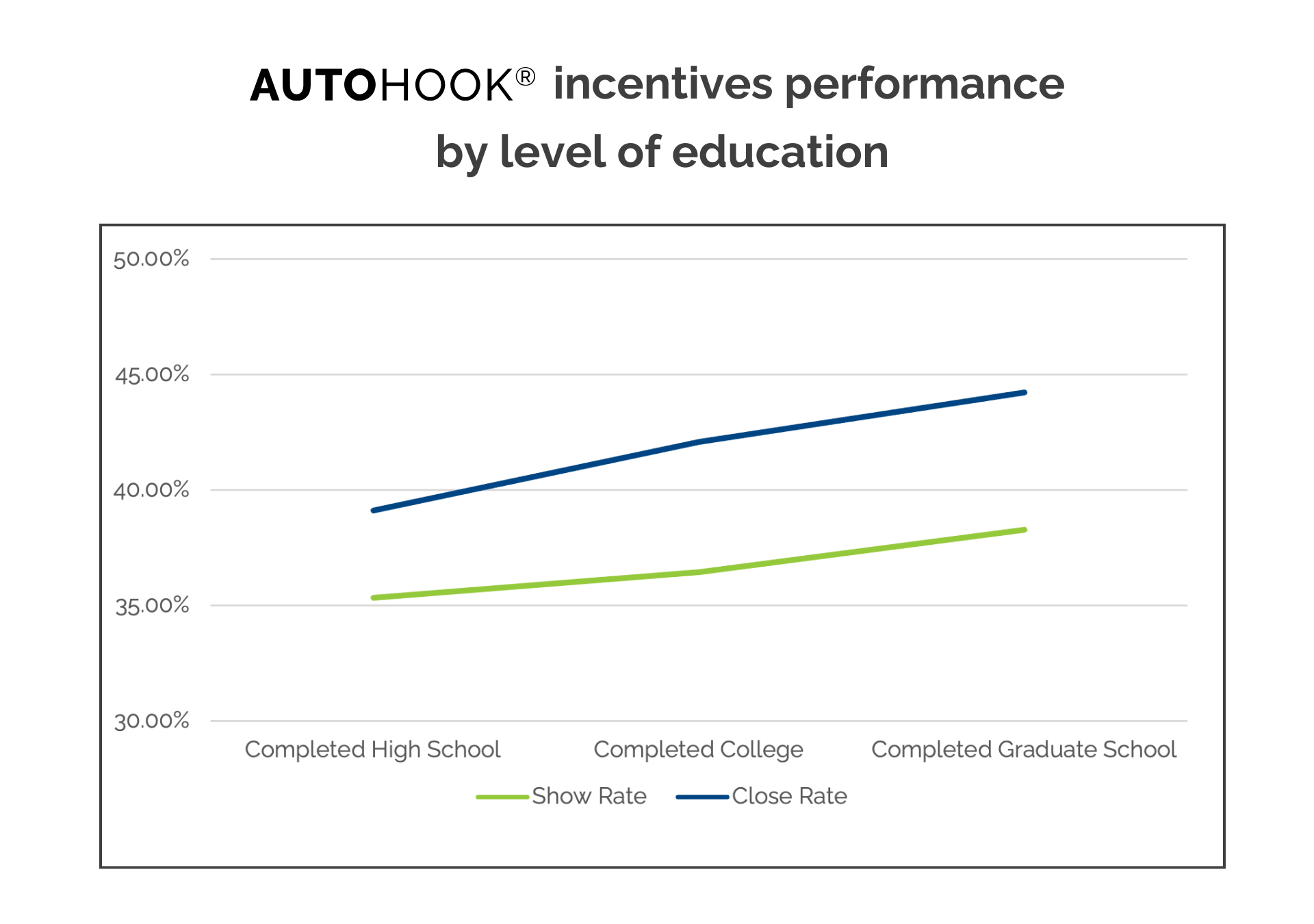

But even those well-qualified leads are motivated by incentives. Urban Science data shows a positive correlation between income and incentive redemptions. That is true for even modest incentives, such as $35. That incentive can significantly impact auto-buyer motivation, from encouraging test drives to considering new electric vehicle (EV) models as noted above.

Some industry insiders believe incentive-based sales strategies are crucial for dealers who want to reduce defection rates and enhance sales effectiveness. This strategy should include intercepting in-market shoppers from the dealer’s website, integrating incentives into lead generation strategies and channels and incorporating them into lead follow-up strategies. Additionally, incentives can help move hard-to-sell inventory and target geographic areas with the most opportunities. Retargeting high-quality buyers later in the follow-up process is essential for maintaining engagement and interest.

In summary, leveraging a targeted strategy that intercepts in-market shoppers, integrates into lead generation and follow-up processes, and targets specific inventory and geographic areas can significantly improve the success rate of well-qualified leads and overall sales effectiveness.