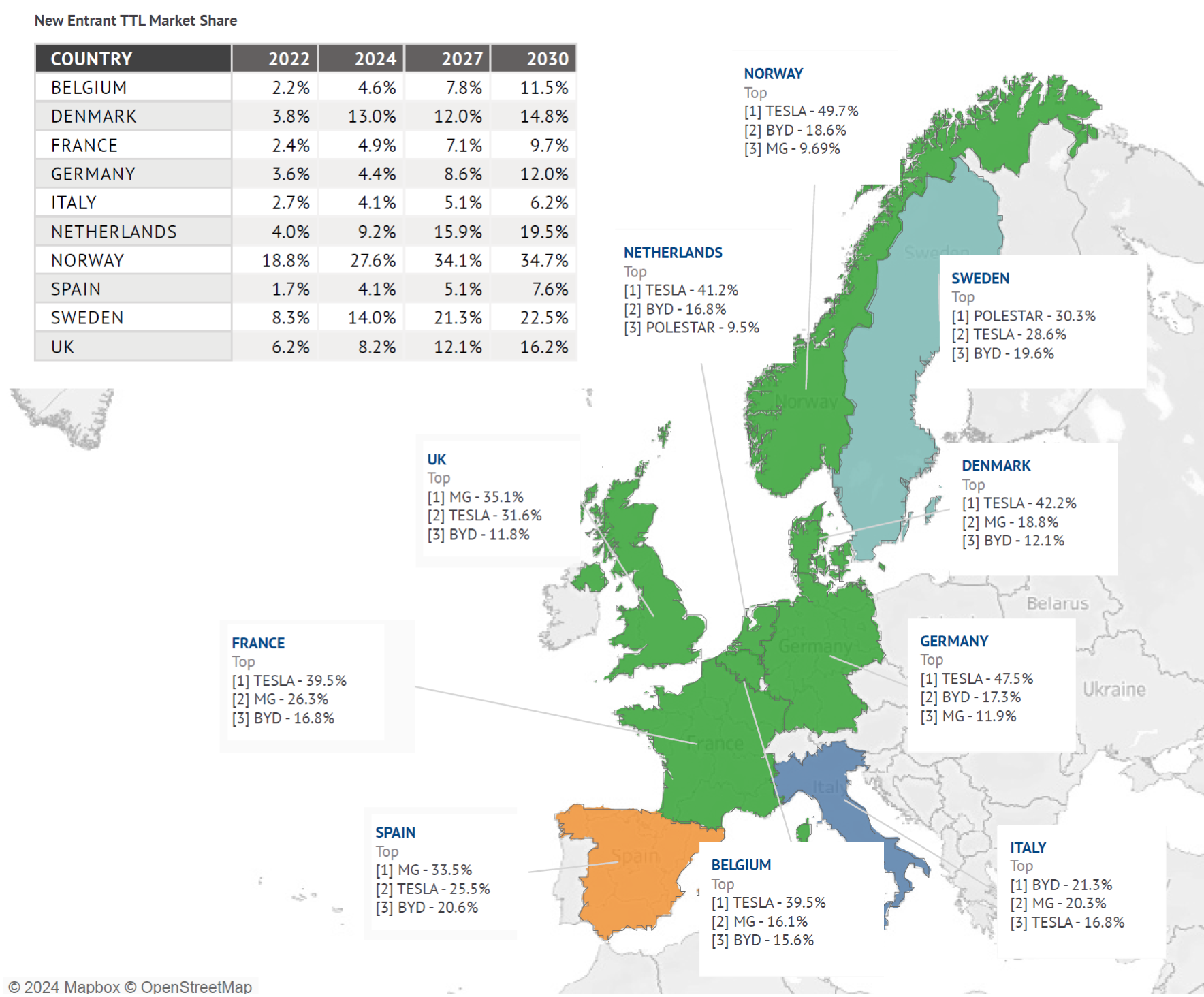

The trend of 20% EV market share increases across the European new vehicle sales market indicates robust and accelerating EV adoption. Traditional automotive manufacturers still command the lion’s share of EV sales, accounting for three-quarters of the market, but their dominance is facing challenges, evidenced by around a 6% EV market share loss in France and Italy, alone. However, traditional automakers can leverage their established brand trust and consumer loyalty, especially in regions where brand identity is deeply valued, to counteract these losses. In contrast, Chinese new entrants are making notable strides, even challenging established players like Tesla for market share dominance. Experts agree that EU tariff bumps will not prevent China’s automakers from taking market share, and identify four key success factors for new entrants: price, technology, scale and brand recognition. While tariff concerns may be causing trepidation, Chinese brands have not indicated stepping back; instead, the tariffs may accelerate the localization of their production.

Chinese automakers’ success hinges on their ability to offer competitively priced vehicles, gain and maintain a technological edge in software and digital experience, tactically scale their operations and build brand recognition. Price remains a key driver, with Chinese brands able to offer lower-priced vehicles compared to established automakers. Additionally, they are sometimes perceived to excel in technology, particularly in software and digital experience, which appeals to younger generations. However, scale and brand recognition remain significant hurdles for Chinese entrants. They must build awareness and deliver high-quality aftersales service to avoid reputational damage and encourage repeat sales. Regarding aftersales networks, established automakers have a significant advantage here with their comprehensive aftersales networks across Europe helping maintain customer satisfaction and loyalty over the long term. With as many as 20 new Chinese brands clamoring for attention, the competition will be fierce and consumer choices potentially confusing.