-

SOLUTIONS

MANUFACTURER

NETWORKPERFORMANCEProactive network management to connect today’s consumers with automotive more efficiently.

SALESPERFORMANCEUncover what really impacts daily performance to grow market share.

AFTERSALESPERFORMANCEBring customers back to increase service retention and build long-term loyalty.

MARKETINGPERFORMANCEScientific precision to make every marketing dollar work harder.

- RESOURCES

- NEWSROOM

- ABOUT US

- CAREERS

- EVENTS

July 15th, 2024

Learning from Today’s EV Owners

This article initiates a series analyzing this year’s Urban Science/Harris Poll survey. The survey delves into consumer perceptions of the relevance of the traditional automobile dealership model.

The adoption of electric vehicles (EVs) in the United States is progressing more gradually than anticipated. However, this gradual pace does not undermine EVs’ emergence as a dominant force in the automotive industry. According to data from the analysis of this year’s Urban Science/Harris Poll survey, one in every five vehicles sold now features an electric powertrain.

Although the growth of battery electric vehicles (BEVs) is slowing, the market continues to evolve. That’s evidenced by data showing consumers are increasingly turning toward the adoption of hybrid vehicles. Consider that hybrid adoption is rising by 31% in 2024. This shift reflects consumer feedback and behavior, as hybrid technology provides a more convenient entry point into electrification.

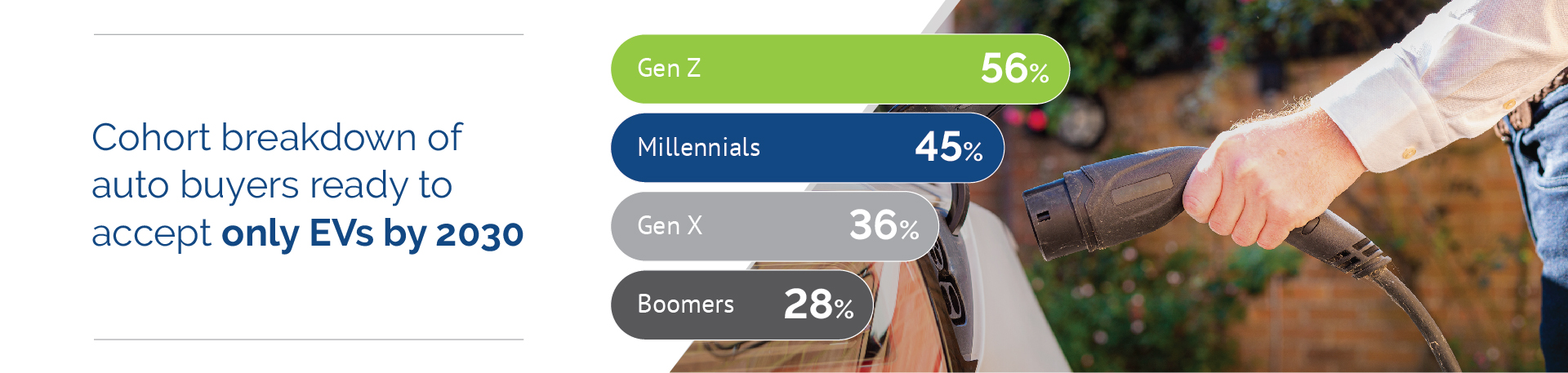

The adoption of hybrid vehicles signals a significant shift in consumer readiness for EVs. And a remarkable 68% of auto buyers indicate they will be ready for an EV by 2035, with 48% expressing readiness by 2030, according to Urban Science data.

These figures have shown year-over-year growth and are particularly pronounced among younger generations specifically Gen Z and millennials.

EV Owners See Dealers as Essential

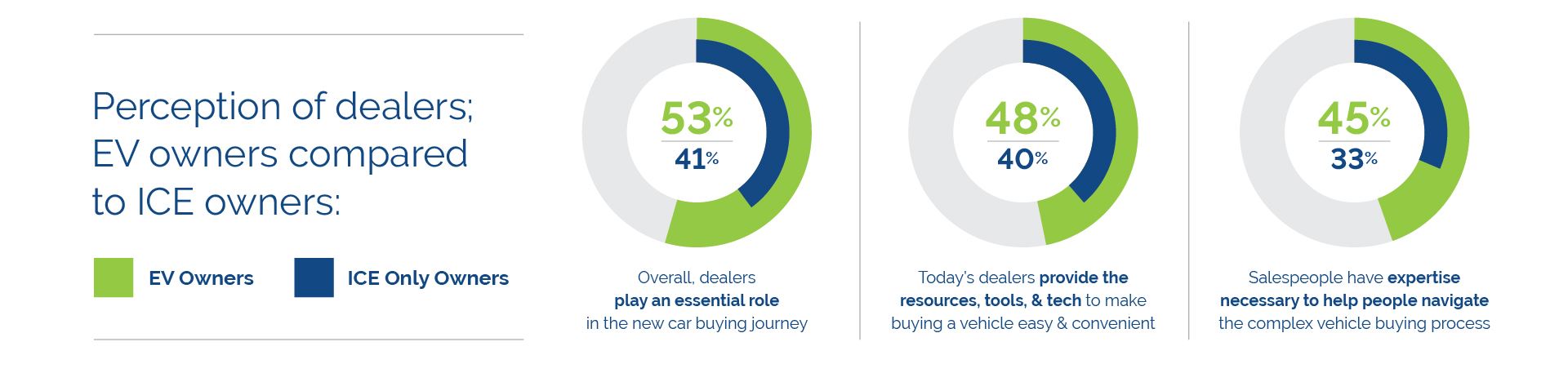

Dealers present a logical and welcome pathway for continuing adoption of EVs. Consumers who choose EVs are more convinced than owners of ICE vehicles that dealers are critical to successful car-buying scenarios. Now is the time for dealers to train staff and prepare facilities to meet consumers’ expectations.

Now more good news for dealers. More than half (67%) of Gen Z consumers are bullish about dealer relevance. And 63% of millennials share that sentiment. As older generations age, Gen Z and millennials are becoming the predominant car buying market.

That gives dealers a clear path toward tapping new consumer pools, strengthening past customer relations and ensuring consumers have the information they need to purchase EVs. Success is possible for dealers who step up to the challenge.

EV Owners and Dealer Perceptions

Dealers increasingly understand the importance of turning their staff into electric vehicle experts who work in EV-ready facilities. And that’s critical to successful EV adoption. Consider that almost half (49%) of EV owners surveyed believe dealerships are optimized for the future. That compares to 36% of ICE owners surveyed.

And courting those EV owners and potential adoptees enhances dealers’ bottom lines. Over the past five years, 66% of dealers report that EVs have somewhat or significantly increased their revenues. Looking ahead, 52% of dealers anticipate moderate growth in their EV strategies, while 28% expect rapid growth over the next five years.

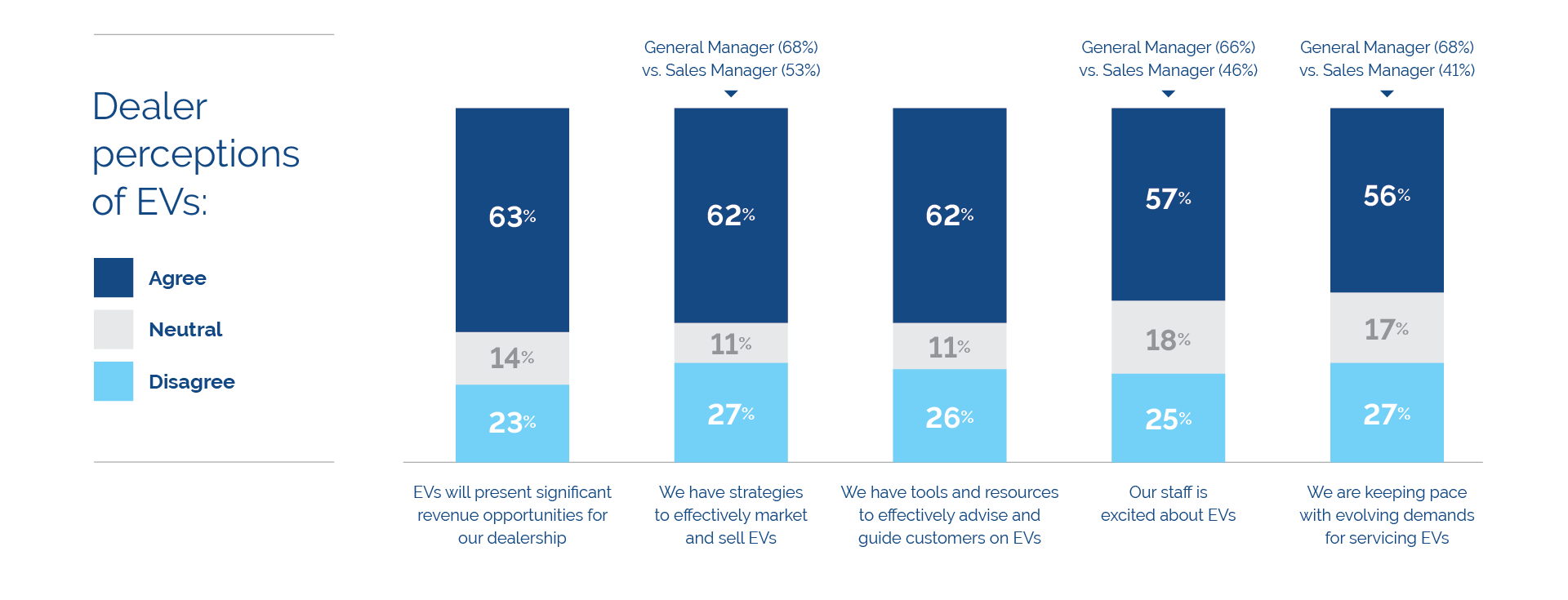

Yet it is still being determined if that success can continue. Dealers need to build staff enthusiasm for EVs. And though many dealers believe they have done just that, the data doesn’t support that belief.

While 62% of dealers strongly agree that they offer the necessary tools, resources and strategies to guide consumers to successful EV adoption, auto buyers disagree. Data shows they increasingly find dealers are behind-the-curve on understanding and advising the marketplace on EVs. In fact 42% strongly agree that dealerships should provide individualized guidance for customers’ transition to EVs.

The disconnect is not only felt between dealers and consumers. It seeps into the dealerships with sales managers and general managers having conflicting views about EV readiness.

Consider that 68% of general managers believe they have a strategy in place, compared to just 53% of sales managers. And although 66% of general managers believe their staff is excited about EVs, only 46% agree. Perhaps the most telling data point – because it involves the profitable service department — is that while 68% of general managers believe they are keeping up with the evolving demands of servicing EVs, only 41% of sales managers agree. A lack of service expertise can puncture dealerships’ profits, some of which are already deflated due to high interest rates, incentives and buyer hesitation.

Overcoming Barriers to EV Adoption

Challenges Faced by Auto Buyers

While EV owners exhibit optimism, a broader examination of all autobuyers reveals significant barriers to widespread EV adoption. These challenges primarily revolve around charge range anxiety and cost, as highlighted by the following concerns:

- Distance on a Single Charge: Data shows 38% of autobuyers are concerned about the distance they can travel on a single charge.

- Initial Cost: 30% of buyers are deterred by the high initial cost of purchasing an EV.

- Recharging Time: 28% of buyers are worried about the length of time it takes to recharge an EV.

- Home Charging Station Installation: 25% of buyers are hesitant due to the need to install a charging station at home.

While dealers alone cannot resolve these issues, they serve as the primary touchpoint between the public and EVs. Therefore, their role in educating consumers and instilling confidence in the transition to EVs is crucial.

Opportunities for Dealers

To effectively address these barriers, dealers must adopt strategic approaches that leverage data and advanced analytics. Key areas of focus include:

- Targeting Potential Buyers: By collaborating with data-driven companies, dealers can utilize rich historical sales data, demographics, and machine learning to make accurate predictions about potential buyers.

- Localized Demand Forecasting: Dealers can tailor their inventories and marketing efforts by informing their strategies with localized demand forecasts.

By focusing on these areas, dealers can play a pivotal role in overcoming the barriers to EV adoption and fostering a smoother transition for consumers. This approach not only addresses immediate challenges but also positions dealers as essential players in the evolving EV market.

1. Source: Urban Science Online Consumer and Dealer Studies, February 2024. These surveys were conducted by The Harris Poll on behalf of Urban Science among 3,005 U.S. adults aged 18+ and 250 U.S. automotive dealers.

Recent insights

April 10th, 2025

Q1 EV Retail Sales Report

This Q1 electric vehicle* (EV) retail sales report features Urban Science’s proprietary 2025 sales insights through March 31st, 2025…

April 2nd, 2025

Urban Science launches new online business planning tool to enhance automaker-dealer alignment and efficiency

New offering creates high-level business plans in minutes, empowers OEMs and dealers to more responsively plan against – and for – transformational market dynamics Urban Science today announced the […]

March 3rd, 2025

Urban Scientists raise $4,600 for LA wildfire relief through company gift-matching campaign

We’re pleased to announce our recent gift-matching campaign raised $4,600 to support wildfire relief efforts in the greater Los Angeles area. Thanks to the generous support of Urban Science employees […]