-

ソリューション

メーカー

NETWORKPERFORMANCE今日の消費者と自動車をより効率的につなぐためのプロアクティブなネットワーク管理。

SALESPERFORMANCE市場シェアを拡大するために、日々のパフォーマンスに本当に影響を与えるものを明らかにします。

AFTERSALESPERFORMANCE顧客を呼び戻すことでサービスの維持率を高め、長期的なロイヤルティを構築します。

マーケティングPERFORMANCE科学的な精度により、マーケティング費用をより効率的に活用できます。

- RESOURCES

- ニュースルーム

- 会社概要

- キャリア

- イベント

11月 72023年

Driving Profits: How European automakers can harness the potential of connected-vehicle technology

Today, more manufacturers than ever are routinely integrating telematics systems into their new vehicles, featuring a mix of hardware and software components. By 2024, it is estimated that 82.7% of all new vehicles will be connected.1 Automakers are capturing and analysing telematics/vehicle-health data to help inform their strategies for moving forward (and monetising) the features and benefits of these new technologies. The slow adoption of connected-vehicle opportunity among new auto buyers can be attributed to customers’ limited understanding of its value, as well as concerns regarding data privacy and collection complexities.

Knowledge is the power that can open and expand new revenue streams

Taking advantage of a vehicle’s onboard telematics starts with the customer. That’s because – unlike in the U.S. – maintenance-related information is usually pulled by the vehicle owner, rather than pushed out by the automaker or retailer. This tremendous opportunity can potentially offset financial losses due to the reduction in service events that newer vehicles, like Electric Vehicles (EVs), require.

But just how substantial is this opportunity? In the U.S., Ford Motor Company is predicting that – by incorporating more advanced software into the trucks and vans in its highly profitable Ford Pro commercial vehicle business – it will be able to grow revenues by $4,000-$5,000 per vehicle in the future.2 All the more reason automakers and retailers need to take the time at delivery to educate owners on “what’s in it for them” and then help them activate their vehicles’ telematics capabilities. Four-out-of-10 customers (39%) are unaware of their vehicle’s connectivity capabilities.

39% of customers are unaware of their vehicle’s connectivity capabilities.

The rise of the smart city, and how connected vehicles can fit in

The increasing pressure on urban infrastructure (particularly as it relates to transportation) has given rise to smart cities. Fully integrating vehicles into these smart cities requires imaginative measures from the government and the automotive and energy industries. Leveraging data and technology can maximise efficiencies across this new energy landscape – including traffic management of connected vehicles – ultimately helping urban environments to become more practical, sustainable, secure and livable for all community members.

Europe, however, has unique technical challenges that make rapid adoption of connected technology as a means to increase service revenue more daunting. Among the technical hurdles to overcome is the sheer diversity of languages, regulations and technology systems scattered across the region. This multifaceted landscape substantially increases the requirements for crafting and sustaining a large enough software infrastructure capable of efficiently collecting and delivering timely service leads to both consumers and retailers.

Tap into service alerts to build both customer trust and service revenue — how connected vehicles fit in

Modern vehicles are designed to provide ongoing information about the status of key elements from the day of delivery. These messages are conveniently relayed to owners through email or specialized apps. This arrangement should ideally result in a triple-win scenario, benefitting not only vehicle owners but also retailers and automakers. Owners gain a heightened sense of control and trust through the enhanced visibility into the health of their vehicles.

For automakers and retailers, these advantageous services help establish a vital and continuous line of communication with their customers, nurturing a relationship that goes beyond the point of sale. Additionally, service alerts provide invaluable information about the status of crucial vehicle conditions that empowers both automakers and retailers to achieve the ultimate objective of direct marketing: reaching the right customer, at the right time, with the right message.

The possibility to continue building relationships and keep owners engaged cannot be overstated in light of the expected reduction of service visits associated with EVs. Leveraging telematics to take immediate action, however, really comes into play through service alerts. Owners who willingly share their vehicle’s service data when it detects mechanical or safety issues provide retailers with a valuable advantage in addressing these concerns promptly.

Retailers who have an owner’s permission can proactively reach out to them during service-alert events to let their customers know they’re aware and concerned about:

- 安全を維持し、注意が必要な緊急の問題を報告します

- 車両の健全性と最適なパフォーマンスを維持し、積極的な対応を可能にします

- 車両の必要なメンテナンスや修理のスケジュールを提案することで利便性を向上

- 予防保守による車両と機器の寿命の最大化

これらのサービスアラートは、当社の調査で示されているように、改善の余地が十分にあるセクターにとって歓迎すべき勝利をもたらします。実際、最近のハリス世論調査では、3 アーバンサイエンスが委託した調査:

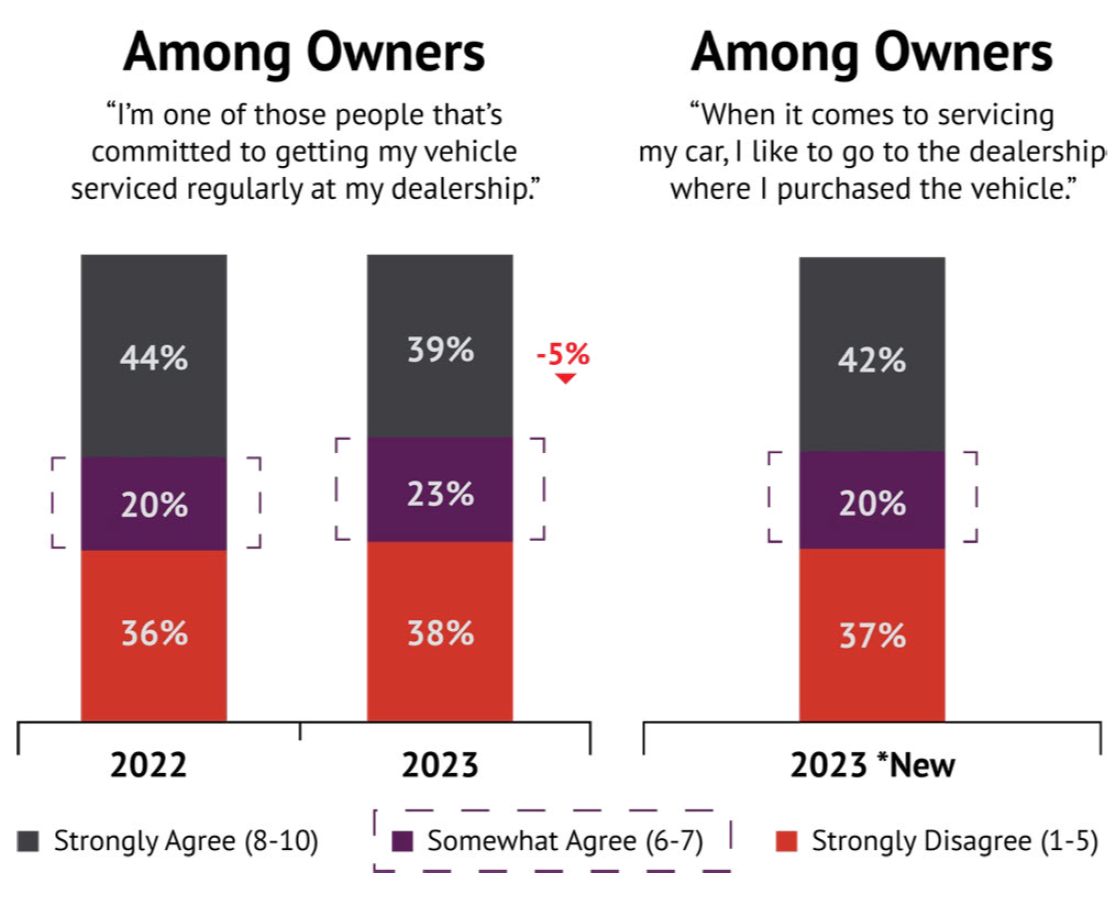

- 39% of auto buyers strongly agree they are “one of those people that’s committed to getting my vehicle serviced regularly at my retailer.” (23% were neutral)

- 42% of auto buyers strongly agree “when it comes to servicing my car, I like to go to the retailer where I purchased the vehicle.” (20% were neutral) EVs in Europe are now (and will increasingly become) a key segment of the telematics opportunity – and the market is growing. With an annual growth rate of 9.72%, EVs are projected to have a market volume of £214.7bn by 2028.4

A real-world example that proves a point

The U.S. has been leveraging telematics data for decades, using it to drive service retention and loyalty. Although marketplace dynamics are certainly different across continents, there are key learnings that can be universally applied for building revenue through connected-vehicle technologies:

- Regular diagnostic reports capture customer attention when communicating vehicle status and health.

- Urgent service alerts inform customers when action is needed, whether for maintenance or mechanical issues (or both).

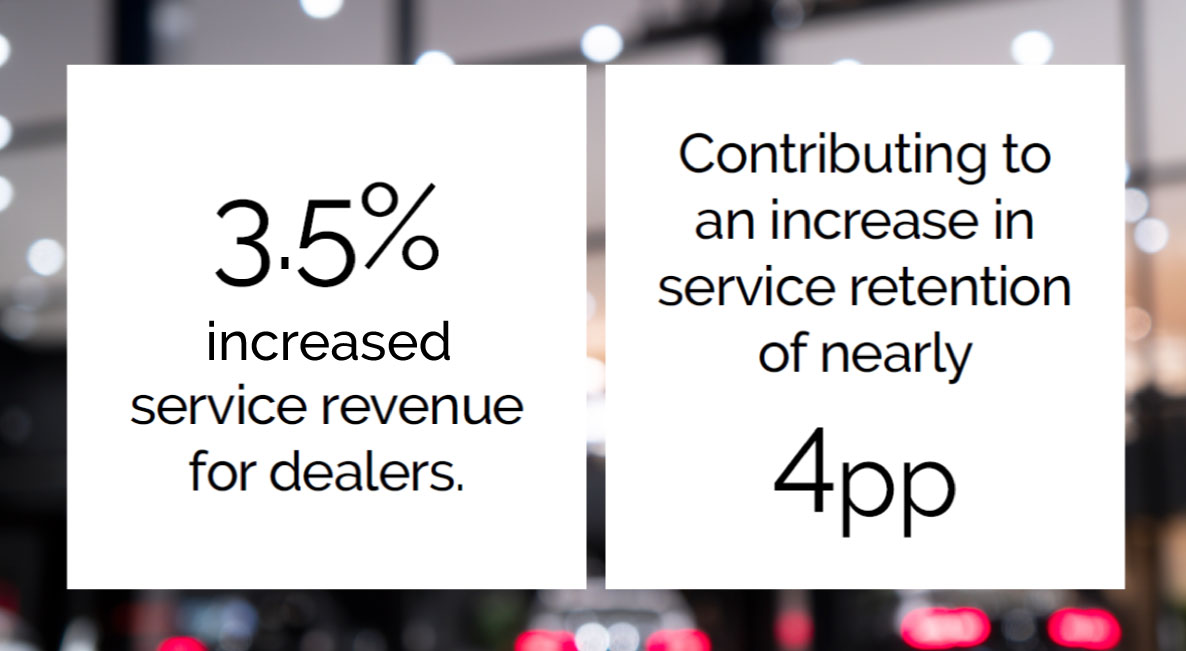

Both automakers and retailers benefit when they take necessary measures to proactively activate vehicle telematics. In fact, our analysis revealed that reaching out to customers at telematics-triggered intervals deliver – on average – a 3.5% increase in service revenue for retailers and contributes nearly four percentage points in higher service retention. That represents hundreds of millions of dollars gained for the average-sized automaker in the U.S.

What automakers and retailers can do 今すぐ

For automakers:

- Leverage telematics with retailers and customers to increase revenue/profitability via repair-order sales by easily (and automatically) identifying owner

vehicles that are due for service or repair - Utilise service alerts to arm customers with insights on what their vehicles need (and when), thereby driving service retention and parts/sales opportunities

- Build trust with customers that can lead to additional opportunities, such as highly targeted subscription service offers

For retailers:

- Encourage salespeople to become more proactive in pursuing telematics opportunities

- Educate customers, beginning at delivery, of the value of telematics

- According to our research, only 32% of car buyers currently rely on salespeople at retailers to learn about new-vehicle features and specifications

- Harness telematics data to nurture relationships and build customer trust

Across all industries, customers are increasingly becoming accustomed to life in a digitally connected world. Manufacturers and retailers need to look for – and take advantage of – an aftersales tool that can optimize the service-alert handling process. If they fail to inform and convince customers of the value of telematics, they risk losing ground to new entrants and competitors who can reach out to customers and more effectively market their products.

解決策としての科学

45 年以上前に設立されて以来、当社の実証済みの科学的な小売計画アプローチは改善と進化を続けてきました。これは、小売ネットワークのパフォーマンス向上に役立つ技術の先端を行くアプローチであり、業界標準であり続けています。

If you’d like to talk to someone at Urban Science about the topics discussed in this article – including learning about ServiceView™ – our aftersales tool that optimizes the service-alert handling process and helps identify and quantify incremental revenue opportunity delivered via telematics – call or email me.

科学の力をあなたの課題にどのように応用できるかをお見せします。 電話またはメールでご連絡ください.

ポール・ディラモア

ポール・ディラモア

マネージングディレクター(英国)

メールアドレス:

+44 7770 605982

1. “The fleets of the future: connected vehicles, telematics and the importance of data for OEMs,”

geotab.com/uk/blog/importance-of-data-for-oems

2. “Ford exec expects software to boost revenue for commercial trucks, vans,”

reuters.com/business/autos-transportation/ford-exec-expects-software-boost-revenue-commercial-trucksvans-2023-08-10

3. This survey was conducted online by The Harris Poll on behalf of Urban Science among 3,022 U.S. adults aged 18+ who currently own or lease or plan to purchase or lease a new or used vehicle in the next 12 months (referred to in this report as “auto-buyers” or “auto-buying public”), and 250 U.S. OEM automotive retailers, whose titles were Sales Manager, General Manager, or Principal/VP/Owner. The auto-buying public survey was conducted from January 26 to February 15, 2023. The retail survey was conducted January 26 to February 17, 2023.

4. “Electric Vehicles: Europe,”

statista.com/outlook/mmo/electric-vehicles/europe?currency=GBP