-

ソリューション

メーカー

NETWORKPERFORMANCE今日の消費者と自動車をより効率的につなぐためのプロアクティブなネットワーク管理。

SALESPERFORMANCE市場シェアを拡大するために、日々のパフォーマンスに本当に影響を与えるものを明らかにします。

AFTERSALESPERFORMANCE顧客を呼び戻すことでサービスの維持率を高め、長期的なロイヤルティを構築します。

マーケティングPERFORMANCE科学的な精度により、マーケティング費用をより効率的に活用できます。

- リソース

- ニュースルーム

- 会社概要

- キャリア

- イベント

7月 312023年

デジタル小売業に関しては、中国の都市部の自動車購入者はすでに先進的だ。

The viability of a complete digital automotive shopping and buying experience has been a hotly debated topic over the years. It picked up momentum during the pandemic, when in-person shopping was, in many markets, partially or completely shut down. The result: people who were reticent to try digital automotive shopping suddenly becoming more comfortable with the proposition. Nowhere has the shift to an acceptance of digital shopping been more dramatic than in urban China – and it’s changing the entire automotive landscape for China’s city dwellers.

The many choices and high expectations of China-based auto buyers

A recent study by The Harris Poll, commissioned by Urban Science, reveals how China-based urban shoppers now feel about the overall automotive customer journey.1 Automakers – from traditional to start-ups – offer auto buyers a wealth of shopping and buying choices, both in-person and digital. With the number of choices available, buyer expectations are high, and they extend to every aspect of the shopping experience. The challenge for any manufacturer or start-up doing business in China’s many urban metropolitan areas is to map out a strategy that enhances the customer experience, regardless of the path shoppers choose in their purchasing journey.

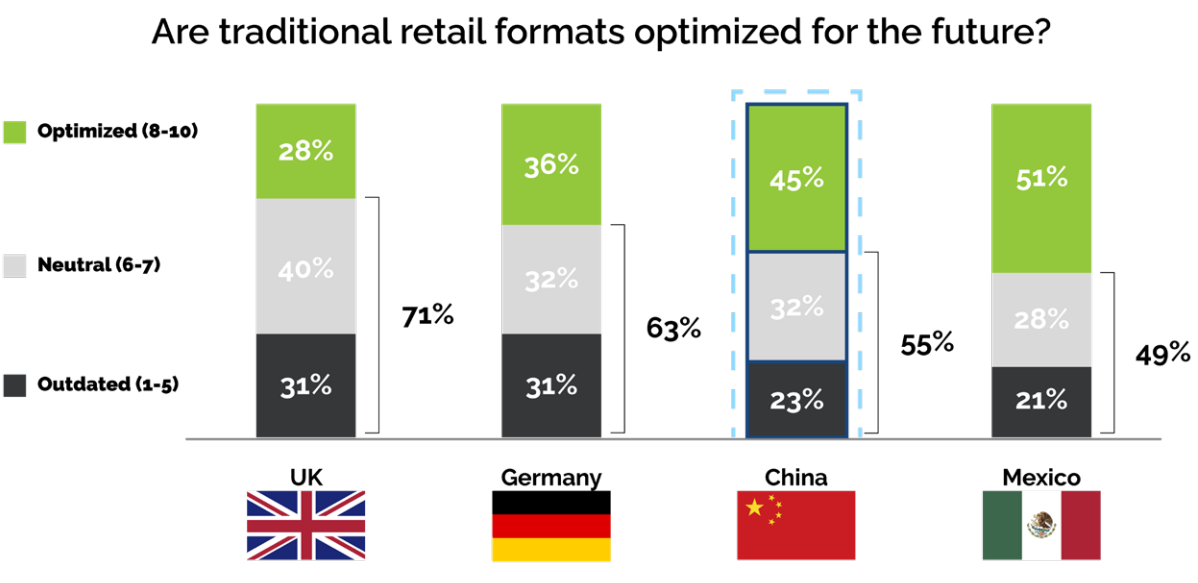

China-based shoppers divided on whether traditional retail formats are optimized for the future

The Finding: When asked “are traditional retail formats optimized for the future?” over half of China-based respondents answered “neutral” or leaned toward “outdated.” Across markets, 45% of China-based buyers say retail formats are optimized for the future, 9 percentage points higher than Germany, and 17 percentage points higher than the UK. Our findings reflect how respondents felt about the role they wanted traditional dealerships to play. There is a growing desire and expectation among consumers that dealers are good consultants, with the expertise necessary to speak to and educate on the latest automotive technology – and how the tech could enhance their lives. In this regard, the work Chinese brands have done to experiment and innovate with their retail formats has paid off in a big way.

The Implications: As technology continues to evolve, reaching the urban China-based shoppers and buyers you most want becomes increasingly challenging. With the new-energy vehicle* (NEV) market becoming a bigger-and-bigger variable in the car-buying equation, it’s essential to have a plan that’s optimized to leverage multiple formats.

* The New Energy Vehicle (NEV) segment is comprised of Battery Electric Vehicles, Hybrid Electric Vehicles, Fuel Cell Electric Vehicles, Hydrogen Powered Vehicles and Extended Range Electric Vehicles.

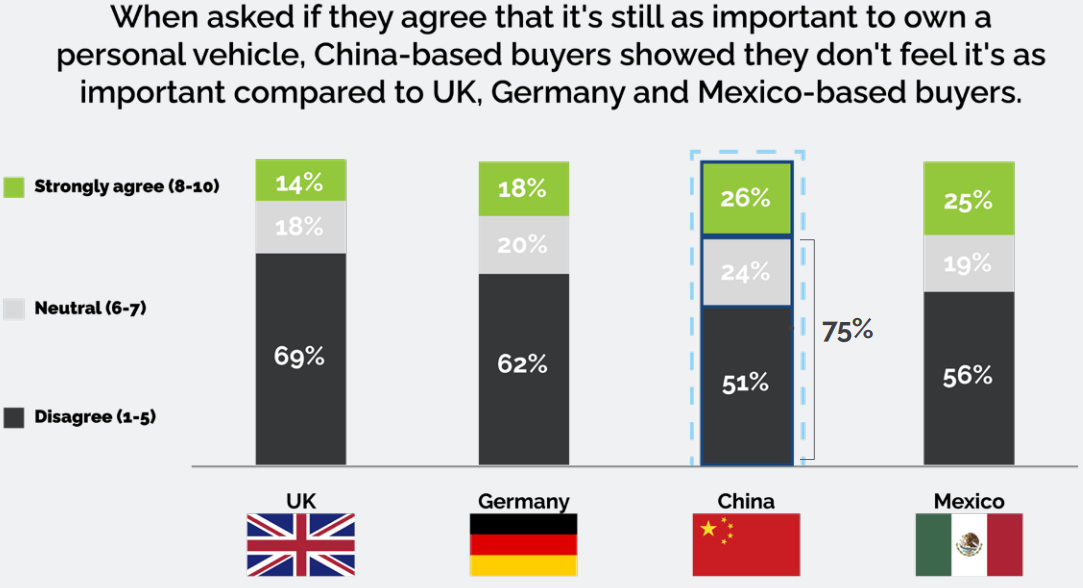

Evolving transportation options changing China’s auto-shopping dynamic

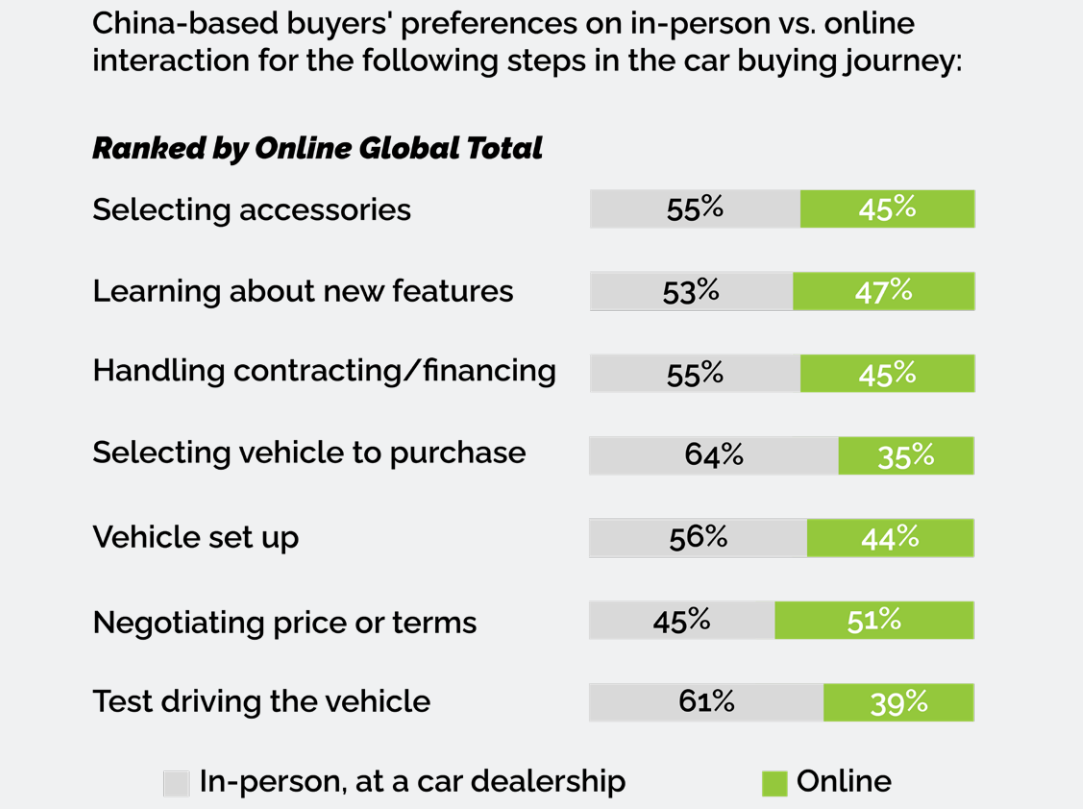

The Finding: 75% of China-based respondents either don’t think owning a personal vehicle is important or have a neutral attitude toward the importance of owning a personal vehicle. Additionally, overall preference for in-person dealership interaction in key global markets, such as the United States, Germany, Mexico and the United Kingdom, is over 65%, while China-based shoppers ranked it lower at 56%. Meanwhile, China-based buyers stand out in their preference for completing various shopping interactions online, including research, vehicle setup, price and terms negotiation, and handling financing details.

The Implications: Over the past decade, China’s transportation infrastructure network – including bus, metro, high-speed train and airport systems – has undergone unprecedented growth in terms of length and quality, placing less importance on owning a personal vehicle. At the same time, vehicle ownership has become more difficult for many China-based buyers – with license plate restrictions getting tighter and seemingly simple factors, such as parking, are becoming less convenient in tier 1 and 2 cities. But for those who do want to own a personal vehicle less of a status symbol, unlike years past. Their motivations revolve around enhancing their quality of life through freedom to go wherever, whenever they want.

The good news is our research findings hint at what dealers need to do. As mentioned earlier, they need to be good consultants and knowledgeable about automotive tech and its advantages. Emphasizing this consultative approach not only plays up the advantages of in-person engagement, but also is a persuasive strategy that lets shoppers know they have an ally, rather than an adversary, in their shopping process.

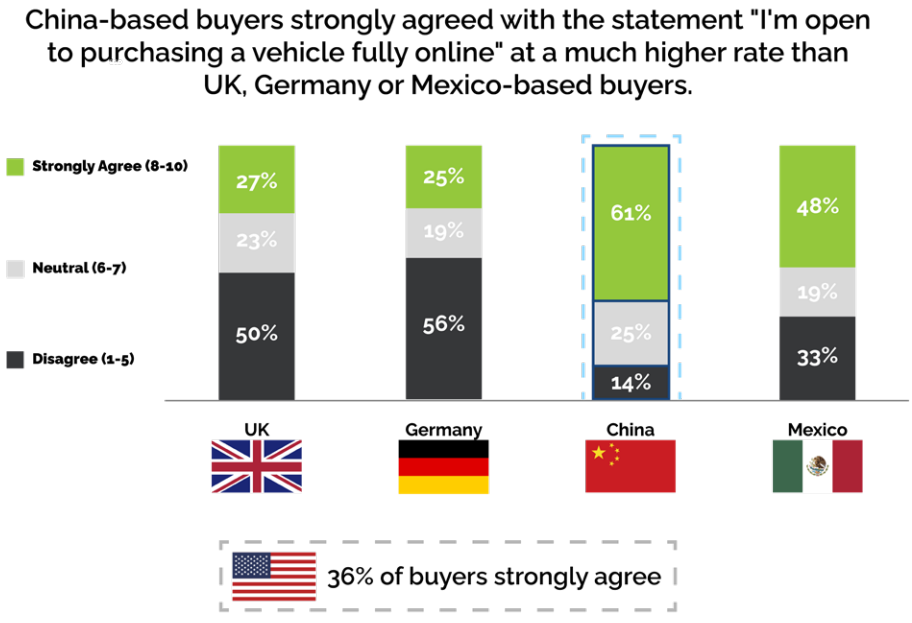

China-based shoppers are very comfortable with purchasing a vehicle fully online… but believe dealers can do better

The Finding: At 61%, China-based respondents exhibit a vast openness toward purchasing a vehicle fully online – 13 percentage points higher than respondents in Mexico (at 48%), and 25 percentage points higher than the US (at 36%).

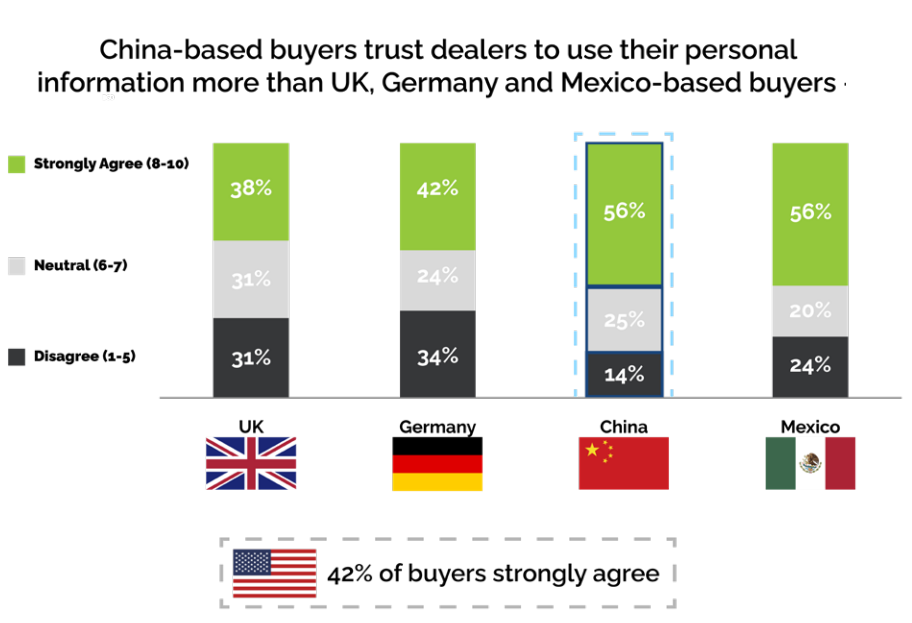

Half of respondents take that a step further, expecting dealerships to engage in helping them purchase a vehicle fully online. The poll also revealed that China-based shoppers were more trusting in dealers to safeguard their personal data (56% compared to 42% in US and Germany, 38% in UK), further bolstering the case for shopping online.

The Implications: With China-based shoppers saying they are both very comfortable buying online and trust dealers to protect their information, it’s incumbent on dealers and manufacturers to educate consumers throughout the purchasing journey and uniquely position key dealership in-person interactions (beyond test drives) – improving the overall brand and customer experience.

The challenge: creating and implementing a strategy that meets the unique wants and needs of China-based auto buyers

China-based shoppers are providing a roadmap for dealership and manufacturer success in China – but like any map, it’s easy to take the wrong path if you don’t have a partner who “knows the way” at the ground level.

In addition to over 40 years of experience in global strategic network planning, Urban Science has over a decade of experience specific to the Chinese mainland and its shoppers. We know and understand the many ways urban shoppers (who are used to highly digital and connected lifestyles), differ from rural shoppers and their needs. We’ve been analyzing and guiding several major manufacturers in the journey from traditional to alternative retail formats. We’re experts in all aspects of dealership operations, and know the challenges of digitalization, including the generational gaps that need to be overcome to fully take advantage of the available opportunities.

We leverage our learned experiences at every level of the automotive network to help guide our process of establishing market share and auto-buyer trust. In order to to succeed in China, OEMs and dealers have to understand:

- China-based auto-buyer preferences surrounding potential digital touch points in the car buying journey

- Where China-based buyers see the most value in in-person dealership interactions

- The evolving shopping/buying dynamics and how they impact dealership operations and performance benchmarking

解決策としての科学

Since our founding over four decades ago, our proven, scientific approach to automotive retailing has continued to improve and evolve. It’s an approach that stays ahead of the technological curve and continues to be the industry standard.

If you’d like to talk to someone at Urban Science about how we can help you better meet your challenges in the China-based automotive market, call or email me. Let us show you how we can help you out-compete the competition.

Chee-Kiang Lim, Managing Director, China, Urban Science, Inc.,

+ 86 186-0111-0515 cklim@urbanscience.com

1. This survey was conducted online by The Harris Poll on behalf of Urban Science between December 9-13, 2022, among 4,730 adults ages 18+ who currently own or lease or plan to purchase or lease a vehicle in the next 12 months (referred to in this report as “auto-buyers”) in the United Kingdom (n=811), Germany (n=847), China (n=931), Mexico (n=1,185), and Australia (n=956). The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within ±3.6 percentage points for United Kingdom, ±3.6 percentage points for Germany, ±4.2 percentage points for China, ±3.2 percentage points for Australia, and ±3.5 percentage points for Mexico, using a 95% confidence level. For complete survey methodology, including weighting variables and subgroup sample sizes, please contact Amy Reed Bowering (arbowering@urbanscience.com).