-

ソリューション

メーカー

NETWORKPERFORMANCE今日の消費者と自動車をより効率的につなぐためのプロアクティブなネットワーク管理。

SALESPERFORMANCE市場シェアを拡大するために、日々のパフォーマンスに本当に影響を与えるものを明らかにします。

AFTERSALESPERFORMANCE顧客を呼び戻すことでサービスの維持率を高め、長期的なロイヤルティを構築します。

マーケティングPERFORMANCE科学的な精度により、マーケティング費用をより効率的に活用できます。

- リソース

- ニュースルーム

- 会社概要

- キャリア

- イベント

12月 112024年

サービスがこれまで以上に重要な理由:EV中心の未来におけるディーラーサービス

この記事は、今年の Urban Science/Harris Poll 調査を分析するシリーズの第 1 弾です。この調査では、従来の自動車販売店モデルの妥当性に関する消費者の認識を詳しく調べています。

As the U.S. automotive world moves toward various electrification choices, dealership service departments are becoming more critical to sales and dealership loyalty. Sales and service have always been connected, but electric vehicles (EVs) technology has bonded them more closely than ever before.

Recent data from Urban Science finds that 56% of surveyed auto buyers strongly agree that dealerships’ service department play a significant role in choosing where to purchase vehicles. That is up 6% from the past year.

In addition, 61% of EV owners strongly agree they prefer to service their vehicle at the dealership where it was purchased. That’s not surprising for many reasons, including the sophisticated technology of EVs.

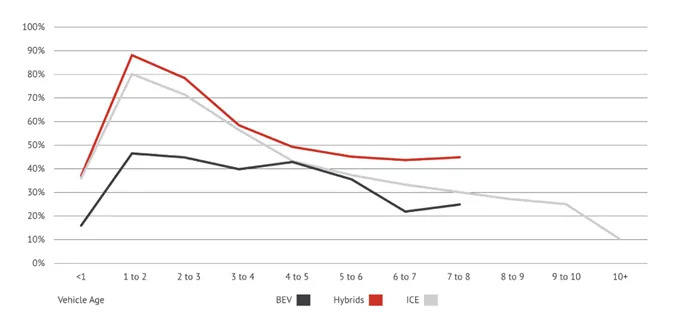

Urban Science research shows service retention for ICE vehicles within franchised dealerships drops after 3- to 4-years. That’s when many warranties expire and trade-ins begin.

How EVs Build Dealership Loyalty

Dealers can expect service loyalty retention to extend beyond that time for electric vehicles. Consider that hybrids require oil change, engine air filter replacement and other routine maintenance commonly associated with ICE vehicles. But hybrids, and indeed all EVs, also need service on battery/EV-components that are unique to their powertrains.

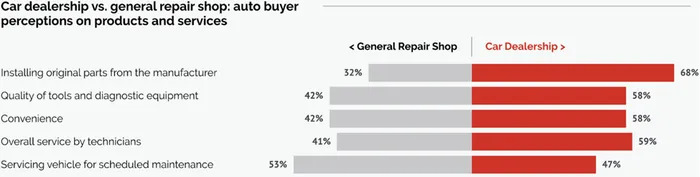

The survey findings from the recent Urban Science report show that hybrid owners value franchise dealerships’ service departments over independent or general repair shops.

Respondents noted they especially value the following from franchise dealerships’ shops:

The Growing Importance of Service for Future Purchases

In the past, service visits were viewed largely as transactional. Customers came in for oil changes or tire rotations, had the work completed, and left. However, with the introduction of more sophisticated vehicle technology — especially in hybrids and EVs — service interactions have evolved into crucial touchpoints that influence customers’ future purchase decisions. In addition, dealers can further educate service customers about hybrids and EVs including features, maintenance and more. Dealerships emphasizing quality service and personalized care have a higher chance of keeping customers engaged and building long-term loyalty.

Service interactions are also unique in offering a dealership multiple opportunities to impress customers and showcase its value. Studies show that consumers who feel satisfied with their service experience are likelier to return when it’s time for their next vehicle purchase. For dealers, every service visit is a chance to foster loyalty, build trust, and remind customers that there are an array of services they may want to adopt. Such personal discussions keep the customer returning to the dealership for service and future purchases. As Urban Science has reported, owners gain trust through enhanced control and confidence in their vehicles, while dealerships and manufacturers grow and maintain strong customer relationships.

Working the Service Lane

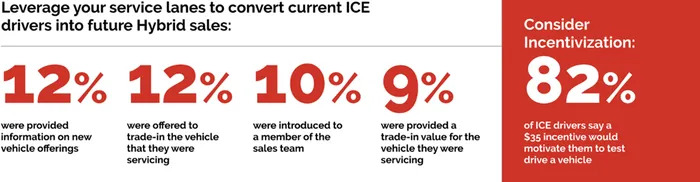

Service lanes are gaining importance as tools to help convert ICE owners to hybrid or EV owners. Consider that Urban Science research shows that auto buyers are now experiencing some of the key interactions that can bridge that gap:

Another service drive opportunity — 82% of auto buyers reported that a $35 incentive would motivate them to test drive an EV and 81% said that it would motivate them to bring their vehicle in for maintenance.

Building an EV-Centric Strategy

As the industry moves toward a more electrified future, dealerships that meld sales and service offerings are more likely to succeed. Consumers, especially EV owners, consider service a prime reason for choosing and remaining loyal to dealerships. Franchise service departments can grow their market shares and retention levels by responding to consumers’ preferences.

*This survey was conducted online by The Harris Poll on behalf of Urban Science among 3,005 US adults aged 18+ who currently own or lease or plan to purchase or lease a new or used vehicle in the next 12 months (referred to in this report as “auto-buyers” or “auto-buying public”), and 250 U.S. OEM automotive dealers, whose titles were Sales Manager, General Manager, or Principal/VP/Owner.

The auto-buying public survey was conducted from January 4 to February 13, 2024. Data are weighted where necessary by demographics to bring them in line with their actual proportions in the population. The dealer survey was conducted January 5 to February 7, 2024. Results were not weighted and are only representative of those who completed the survey.

The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within ±2.3 percentage points for US auto-buyers and ±6.2 for U.S. OEM automotive dealer using a 95% confidence level.

For complete survey methodology, including weighting variables and subgroup sample sizes, please contact Amy Bowering (arbowering@urbanscience.com).

最近の洞察

2月 18th, 2026

Online Actions + Offline Sales = Big Wins

Programmatic media is a staple among automotive advertisers, but measuring the success of a particular media exposure can be tricky. A…

2月 17th, 2026

Urban Science 2025 Franchise Activity Report: 95% Of U.S. Markets Held Steady, New Jersey Tops Nation For Dealership Growth

Urban Science® today announced highlights from its 2025 Year-End Automotive Franchise Activity Report (FAR), which shows continued stability…

2月 15th, 2026

DriveCentric × Urban Science at NADA 2026: Turning Data Into Daily Execution

At NADA 2026, Eric DeMont, global product director at Urban Science, joined DriveCentric’s Steve Roessler and Cable Dahmer Automotive Group’s Brittany Ouellette to show how effective CRM usage drives real […]