-

解决方案

MANUFACTURER

NETWORKPERFORMANCE主动网络管理可以更有效地将当今的消费者与汽车连接起来。

SALESPERFORMANCE发现真正影响日常绩效以增加市场份额的因素。

AFTERSALESPERFORMANCE让顾客回头以提高服务保留率并建立长期忠诚度。

营销PERFORMANCE科学的精准度让每一分营销费用都发挥更大的作用。

- RESOURCES

- 新闻

- 关于我们

- 职业

- 活动

11月7日2023 年

Driving Profits: How European automakers can harness the potential of connected-vehicle technology

Today, more manufacturers than ever are routinely integrating telematics systems into their new vehicles, featuring a mix of hardware and software components. By 2024, it is estimated that 82.7% of all new vehicles will be connected.1 Automakers are capturing and analysing telematics/vehicle-health data to help inform their strategies for moving forward (and monetising) the features and benefits of these new technologies. The slow adoption of connected-vehicle opportunity among new auto buyers can be attributed to customers’ limited understanding of its value, as well as concerns regarding data privacy and collection complexities.

Knowledge is the power that can open and expand new revenue streams

Taking advantage of a vehicle’s onboard telematics starts with the customer. That’s because – unlike in the U.S. – maintenance-related information is usually pulled by the vehicle owner, rather than pushed out by the automaker or retailer. This tremendous opportunity can potentially offset financial losses due to the reduction in service events that newer vehicles, like Electric Vehicles (EVs), require.

But just how substantial is this opportunity? In the U.S., Ford Motor Company is predicting that – by incorporating more advanced software into the trucks and vans in its highly profitable Ford Pro commercial vehicle business – it will be able to grow revenues by $4,000-$5,000 per vehicle in the future.2 All the more reason automakers and retailers need to take the time at delivery to educate owners on “what’s in it for them” and then help them activate their vehicles’ telematics capabilities. Four-out-of-10 customers (39%) are unaware of their vehicle’s connectivity capabilities.

39% of customers are unaware of their vehicle’s connectivity capabilities.

The rise of the smart city, and how connected vehicles can fit in

The increasing pressure on urban infrastructure (particularly as it relates to transportation) has given rise to smart cities. Fully integrating vehicles into these smart cities requires imaginative measures from the government and the automotive and energy industries. Leveraging data and technology can maximise efficiencies across this new energy landscape – including traffic management of connected vehicles – ultimately helping urban environments to become more practical, sustainable, secure and livable for all community members.

Europe, however, has unique technical challenges that make rapid adoption of connected technology as a means to increase service revenue more daunting. Among the technical hurdles to overcome is the sheer diversity of languages, regulations and technology systems scattered across the region. This multifaceted landscape substantially increases the requirements for crafting and sustaining a large enough software infrastructure capable of efficiently collecting and delivering timely service leads to both consumers and retailers.

Tap into service alerts to build both customer trust and service revenue — how connected vehicles fit in

Modern vehicles are designed to provide ongoing information about the status of key elements from the day of delivery. These messages are conveniently relayed to owners through email or specialized apps. This arrangement should ideally result in a triple-win scenario, benefitting not only vehicle owners but also retailers and automakers. Owners gain a heightened sense of control and trust through the enhanced visibility into the health of their vehicles.

For automakers and retailers, these advantageous services help establish a vital and continuous line of communication with their customers, nurturing a relationship that goes beyond the point of sale. Additionally, service alerts provide invaluable information about the status of crucial vehicle conditions that empowers both automakers and retailers to achieve the ultimate objective of direct marketing: reaching the right customer, at the right time, with the right message.

The possibility to continue building relationships and keep owners engaged cannot be overstated in light of the expected reduction of service visits associated with EVs. Leveraging telematics to take immediate action, however, really comes into play through service alerts. Owners who willingly share their vehicle’s service data when it detects mechanical or safety issues provide retailers with a valuable advantage in addressing these concerns promptly.

Retailers who have an owner’s permission can proactively reach out to them during service-alert events to let their customers know they’re aware and concerned about:

- 维护他们的安全并标记需要注意的紧急问题

- 车辆的健康和最佳性能,能够主动关注

- 通过安排车辆必要的维护和/或维修来提高便利性

- 通过预防性维护最大程度延长车辆和设备的使用寿命

我们的研究表明,这些服务警报为这个还有足够改进空间的行业带来了可喜的胜利。事实上,在最近的哈里斯民意调查中3 由 Urban Science 委托进行的调查:

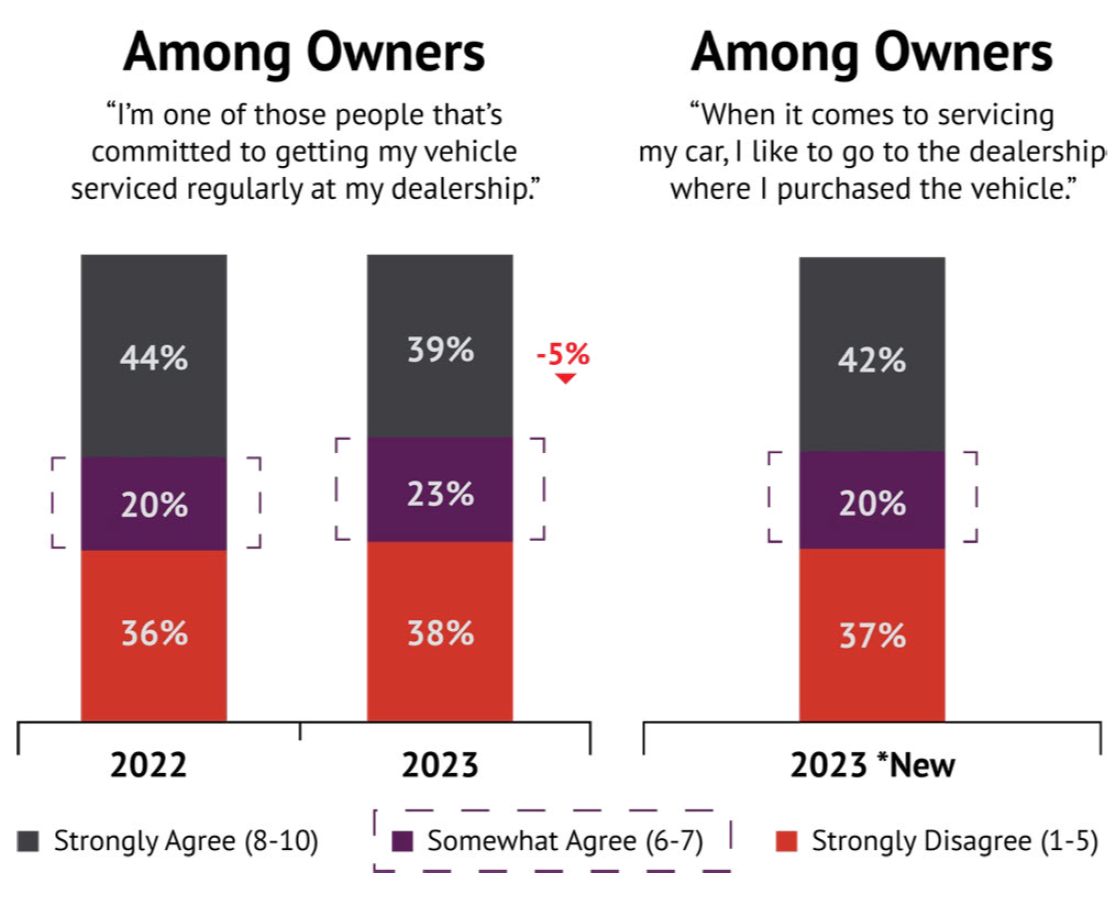

- 39% of auto buyers strongly agree they are “one of those people that’s committed to getting my vehicle serviced regularly at my retailer.” (23% were neutral)

- 42% of auto buyers strongly agree “when it comes to servicing my car, I like to go to the retailer where I purchased the vehicle.” (20% were neutral) EVs in Europe are now (and will increasingly become) a key segment of the telematics opportunity – and the market is growing. With an annual growth rate of 9.72%, EVs are projected to have a market volume of £214.7bn by 2028.4

A real-world example that proves a point

The U.S. has been leveraging telematics data for decades, using it to drive service retention and loyalty. Although marketplace dynamics are certainly different across continents, there are key learnings that can be universally applied for building revenue through connected-vehicle technologies:

- Regular diagnostic reports capture customer attention when communicating vehicle status and health.

- Urgent service alerts inform customers when action is needed, whether for maintenance or mechanical issues (or both).

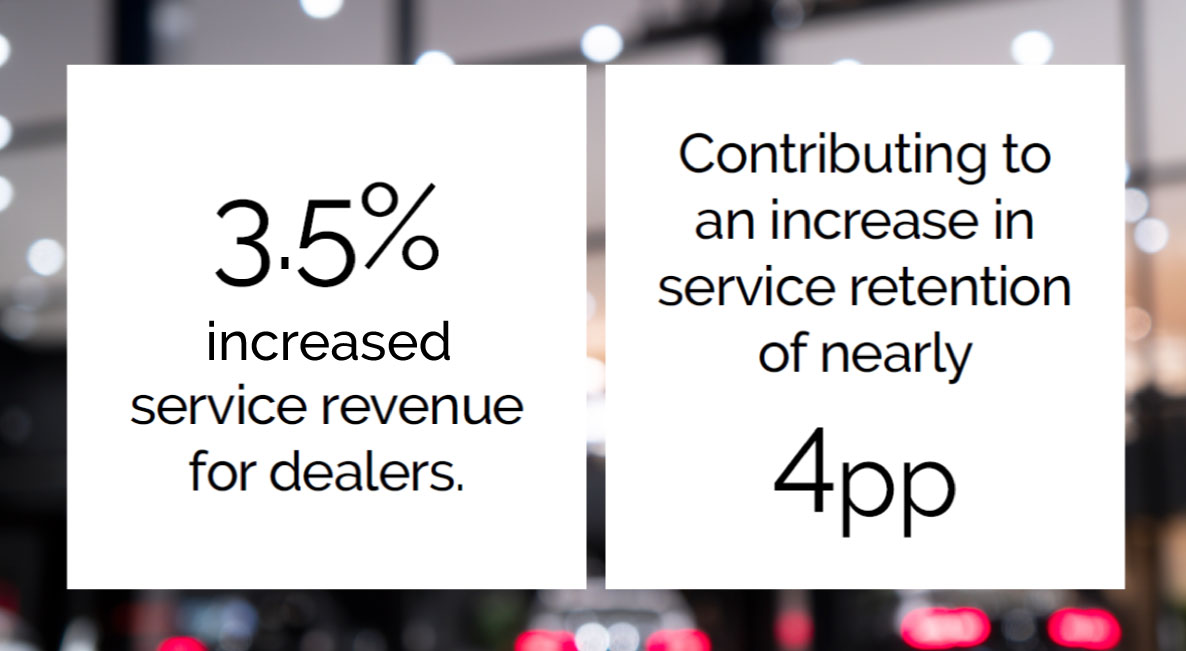

Both automakers and retailers benefit when they take necessary measures to proactively activate vehicle telematics. In fact, our analysis revealed that reaching out to customers at telematics-triggered intervals deliver – on average – a 3.5% increase in service revenue for retailers and contributes nearly four percentage points in higher service retention. That represents hundreds of millions of dollars gained for the average-sized automaker in the U.S.

What automakers and retailers can do 现在

For automakers:

- Leverage telematics with retailers and customers to increase revenue/profitability via repair-order sales by easily (and automatically) identifying owner

vehicles that are due for service or repair - Utilise service alerts to arm customers with insights on what their vehicles need (and when), thereby driving service retention and parts/sales opportunities

- Build trust with customers that can lead to additional opportunities, such as highly targeted subscription service offers

For retailers:

- Encourage salespeople to become more proactive in pursuing telematics opportunities

- Educate customers, beginning at delivery, of the value of telematics

- According to our research, only 32% of car buyers currently rely on salespeople at retailers to learn about new-vehicle features and specifications

- Harness telematics data to nurture relationships and build customer trust

Across all industries, customers are increasingly becoming accustomed to life in a digitally connected world. Manufacturers and retailers need to look for – and take advantage of – an aftersales tool that can optimize the service-alert handling process. If they fail to inform and convince customers of the value of telematics, they risk losing ground to new entrants and competitors who can reach out to customers and more effectively market their products.

科学作为解决方案

自 45 年前成立以来,我们经过验证的科学零售商规划方法一直在不断改进和发展。这种方法始终走在技术前沿,有助于提高零售商网络的绩效,并且仍然是行业标准。

If you’d like to talk to someone at Urban Science about the topics discussed in this article – including learning about ServiceView™ – our aftersales tool that optimizes the service-alert handling process and helps identify and quantify incremental revenue opportunity delivered via telematics – call or email me.

让我们向您展示如何运用科学的力量来解决您的挑战。 给我打电话或发邮件.

保罗·迪拉莫尔

保罗·迪拉莫尔

英国董事总经理

pmdillamore@urbanscience.com

+44 7770 605982

1. “The fleets of the future: connected vehicles, telematics and the importance of data for OEMs,”

geotab.com/uk/blog/importance-of-data-for-oems

2. “Ford exec expects software to boost revenue for commercial trucks, vans,”

reuters.com/business/autos-transportation/ford-exec-expects-software-boost-revenue-commercial-trucksvans-2023-08-10

3. This survey was conducted online by The Harris Poll on behalf of Urban Science among 3,022 U.S. adults aged 18+ who currently own or lease or plan to purchase or lease a new or used vehicle in the next 12 months (referred to in this report as “auto-buyers” or “auto-buying public”), and 250 U.S. OEM automotive retailers, whose titles were Sales Manager, General Manager, or Principal/VP/Owner. The auto-buying public survey was conducted from January 26 to February 15, 2023. The retail survey was conducted January 26 to February 17, 2023.

4. “Electric Vehicles: Europe,”

statista.com/outlook/mmo/electric-vehicles/europe?currency=GBP