EVs in Australia:

It’s a Question of Time.

Insights from a recent Harris Poll commissioned by Urban Science.

The EV tide that has swept up a good portion of the globe is now washing up on Australia’s shores. While today, only 2% of all cars in Australia are electric, the readiness of Australian auto buyers to consider EV-only options is at 14% and is expected to reach a tipping point of more than 50% in seven short years1.

Those numbers are all the more eye-opening when considering not only the vast size of the country but also the infrastructure changes that will need to be made to accommodate an EV future in Australia.

Auto Buyers Split Among Three Different Categories of Readiness.

A recent survey by The Harris Poll2 commissioned by Urban Science reveals three categories of EV readiness among Australian auto buyers:

- Ready Now — in which 34%* of auto buyers are ready either now 或者 by 2025 to consider EV-only options. This category of buyers is comprised of innovators, early adopters and those who will become the early majority.

- Ready Soon — where 33% of auto buyers are ready to consider EV-only options between 2030-2040 (the late majority).

- Unsure When — Nearly a third (30%) of auto buyers in the survey can be described as unsure 或者 never willing to accept EV-only options.

*This increases to 36% when including those who already own an electric vehicle as their only vehicle.

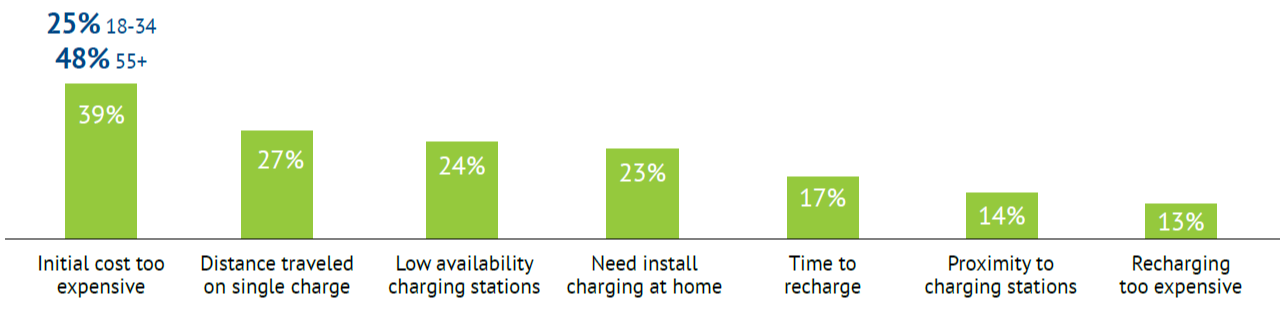

The numbers reflected in the poll become more revealing – and more generationally distinct – when drilling down into the barriers currently preventing auto buyers from considering an EV within the next 12 months.

Concern Over Initial Cost and “Charge Anxiety” Vary Across Categories.

Overall, the top barrier for 39% of auto buyers was initial cost. This barrier was highest among those 55 and older (48%), and lowest for those aged 18-34 (25%). These findings follow along the age/demographic lines for the adoption of other high-ticket items, where the additional costs of home ownership and raising a family don’t factor into the purchase equation for younger adults.

Charge Anxiety, which covers range, availability of charging stations and home-charging capabilities, time to charge, along with the overall cost of charging, is another significant barrier. Here, the attitudinal differences toward considering an EV reflect both where a survey respondent lives (with urban buyers who live close to where they work being less concerned about range), and age. Young, early adopters are likely to be from higher socio-economic groups with greater disposable household income.

Marketing the EV proposition to these different groups will need to vary based on a target’s age, where they live, and how they see an EV fitting into their lifestyle. Auto buyers know the EV future is coming, and they have strong opinions regarding what they want that future to look like.

What Auto Buyers Want in an EV Future.

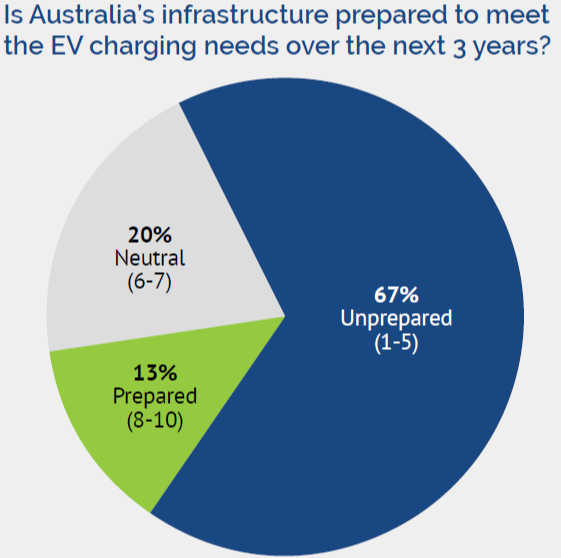

Australia’s auto buyers understand the implications on the nation’s infrastructure when it comes to electrified vehicles, with 67% stating that it is unprepared to meet charging needs in the next three years. They also know it will take time for technology to provide truly fast charging in public places. Not surprisingly, then, 68% of auto buyers would prefer to rely on home charging, restating their perception that the charging infrastructure is unprepared outside of the home environment.

Although initial cost, as stated above, is a major barrier to EV consideration, nearly half of the respondents (49%), would prefer home fast charging (within 2-3 hours). That’s despite knowing the additional expense home charging adds to the overall EV cost of ownership.

Consumer demand – where 14% are ready now to accept only EV options – can be expected to increase rapidly. In fact, by 2025, that ratio will change to 20%, totaling 34% in just 3 years time. Over the next few years, the EV future will evolve to become the EV reality. Fortunately, there are ways to better prepare for that reality. While what works in one country won’t necessarily work in another, it is worth studying some of the cause-and-effects of what others have done (and are doing) to transform from ICE to EV vehicles.

Lessons from Abroad May Foreshadow a Better Path Forward.

A number of other nations have had a head start on the road to EV adoption. China holds the distinction of being the largest EV market, with 2022 sales of 5.9M3 vehicles, more than double that of second-place Europe (2.6M). U.S. 2022 EV sales, at 920,000 vehicles, were a distant third.

The reasons for the disparity in EV adoption among these nations often come down to philosophical and political differences. Many of the barriers to entry, however – such as initial high cost, charge anxiety and infrastructure – are universal.

Attempts to overcome these barriers have been met with mixed results. Chinese manufacturers are attempting to overcome the initial high costs of EV by introducing more low cost models, like BYD’s Seagull, which is a compact hatchback about half the price of their Atto 3 SUV. In the U.S., EV credits, tax breaks and incentives vary – though many credits are confusing to the average auto buyer. According to a recent article in the Washington Post4, “Dealers say the lack of clarity has made it hard for them to promote EVs to buyers because no one is sure how long certain vehicles will qualify for the $7,500 credit — undermining a perk that was designed to accelerate the White House’s green-energy agenda.”

It’s clear that government assistance for EV adoption warrants careful observation. So far, it is yet to prove sustainable in a market economy. Real-world test cases are happening now; Australia’s best path forward will depend on the ability to adopt best practices applicable to the country’s specific wants and needs.

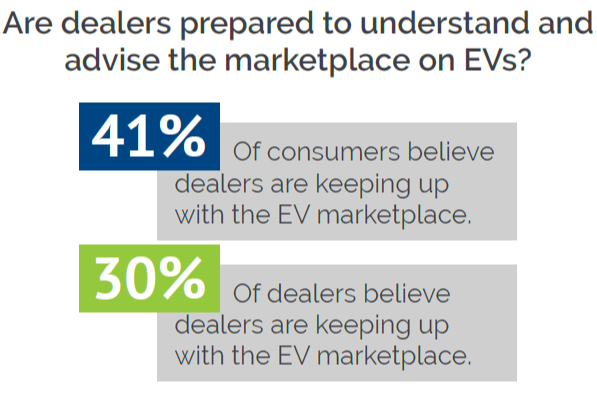

In the United States, where the vast majority of new-vehicle sales are conducted through dealerships, there is a significant difference between consumer and dealer perceptions regarding dealership EV readiness5. It’s interesting to note that a higher percentage of consumers (41%) felt dealers were keeping up with EV challenges compared with how dealers, themselves, felt about their EV readiness (30%).

In the United States, where the vast majority of new-vehicle sales are conducted through dealerships, there is a significant difference between consumer and dealer perceptions regarding dealership EV readiness5. It’s interesting to note that a higher percentage of consumers (41%) felt dealers were keeping up with EV challenges compared with how dealers, themselves, felt about their EV readiness (30%).

The EV Impact on Network Planning.

Many factors have altered consumer buying-and-spending habits over the past few years, exacerbated by the pandemic which caused people – and the companies they work for – to look at work and the daily commute differently.

Network planning needs to embrace changing mindsets and the charging infrastructure with knowledge, experience … and science, including:

- Understanding where and when EV demand is likely to rise and how to evolve your network to capture the opportunity

- Ensuring a seamless transition between consumers’ digital-to-physical experiences

- Understanding how location intelligence can produce a more relevant placement of alternative retail formats to increase consumers’ exposure to EVs

- Investing in education for dealers and consumers to make the most of the opportunity – and potential – that EVs promise

- Marketing to different groups of consumers based on their needs, helping them overcome the anxieties of EV ownership and proving the value of an EV purchase

With careful planning, Australia can ride the global EV wave to a sustainable and profitable future.

科学作为解决方案。

Since our founding over four decades ago, our proven, scientific approach to automotive retailing has continued to improve and evolve. It’s an approach that stays ahead of the technological curve and continues to be the industry standard.

让我们向您展示如何帮助您超越竞争对手。 If you’d like to talk to someone at Urban Science about how we can help you better prepare for the EV future, call or email me.

Mark Patton

Country Manager

Australia, Urban Science, Inc.

mjpatton@urbanscience.com

1. “Global EV Market Grew 55% in 2022 with 59% of EVs sold in Mainland China,”

canalys.com/newsroom/global-ev-sales-2022

2. This survey was conducted online by The Harris Poll on behalf of Urban Science between December 9-13, 2022, among 956 adults ages 18+ who currently own or lease or plan to purchase or lease a vehicle in the next 12 months (referred to in this report as “auto-buyers”) in Australia.

3. “Global EV market grew 55% in 2022 with 59% of EVs sold in Mainland China,”

canalys.com/newsroom/global-ev-sales-2022

4. “Confusion Over EV Tax Credits Stymies Buyers and Sellers,”

washingtonpost.com/us-policy/2023/02/28/ev-tax-credit-vehicles

5. “2023 DTI and Thought Leadership Research,” This survey was conducted online by The Harris Poll on behalf of Urban Science among 3,022 U.S. adults aged 18+ who currently own or lease or plan to purchase or lease a new or used vehicle in the next 12 months (referred to in this report as “auto-buyers” or “auto-buying public”), and 250 U.S. OEM automotive dealers, whose titles were Sales Manager, General Manager, or Principal/VP/Owner. The auto-buying public survey was conducted from January 26-February 15, 2023. Data are weighted where necessary by age, by gender, race/ethnicity, region, education, marital status, household size, household income, and propensity to be online to bring them in line with their actual proportions in the population. The dealer survey was conducted January 26-February 17, 2023. Results were not weighted and are only representative of those who completed the survey.